#TAX

Greece Targets Vacant Bank-Owned Housing With New ENFIA Penalty Tax

The regulation includes an important exemption aimed at encouraging the use of housing stock.

Greek Government Prepares New Tax Cuts on Back of Stronger Revenues

Greek government is considering a new wave of fiscal measures that could begin rolling out in 2026, supported by extra fiscal space from the 2025 defence spending escape clause.

Greece Tightens Controls on Costly Real Estate Tax Exemptions

According to official data, total tax expenditures amount to €22.88 billion, of which nearly 40% relate to exemptions in capital taxation.

No Sugar or Fat Tax: Greece Rules Out Health Levy on Food in 2026

Across the EU, taxes on high fat, sugar and salt (HFSS) products are currently applied in 12 member states, while taxes on sugar-sweetened beverages have been introduced in 108 countries worldwide, according to data from the World Health Organization.

Greece Weighs Advance Tax Rulings to Boost Investor Certainty

The proposed framework aims to reduce the ambiguity that companies and investors often face when planning investments or structuring business transactions.

Greece Weighs Advance Tax Rulings to Boost Certainty for Investors

The Greek government is exploring the introduction of preliminary tax decisions, widely known internationally as Advance Tax Rulings (ATRs), as part of a broader effort to enhance tax certainty and predictability for businesses.

Greece’s Shadow Economy Still Looms Large Despite Digital Tax Reform Plans

Tax evasion remains a structural problem for the Greek economy.

Billion-Euro Exemption Sparks Questions Over Greece’s Fiscal Priorities

What seemed like a technical legislative detail has had major fiscal implications.

Greece Tightens Asset Checks on Tax Authority Staff

Under the new rules, not only AADE employees but also their family members may be examined if their financial information affects the overall picture of an employee’s wealth.

A Decade of Expanding Tax Breaks in Greece Leaves Vulnerable Citizens Behind

Although some relief measures are designed for low-income or disadvantaged groups, the overall structure skews heavily toward those with substantial assets or access to specialised tax regimes.

Amid Rising Rates Across Europe, Greece Stands Out With Ultra-Low Dividend Tax

At the opposite end of the spectrum are Estonia, Latvia and Malta, none of which impose any tax on dividends.

Eurobank Wins Seven-Year Legal Battle Over €29 Million Romanian Tax Dispute

Under the terms of the sale agreement, Eurobank would have been liable for the amount if the ruling became final.

Greece’s Energy Sector Strained by Heavy Tax Burden

Electricity is treated separately, with taxes calculated per megawatt hour.

Greece Bets on AI and Automation in Landmark Tax Administration Reform

Tax returns will be pre-filled automatically with existing data, while taxpayers will receive personalized reminders and guidance.

Hybrids and Small Cars Emerge as Winners in Greece’s New Tax Regime

A new Toyota Corolla Hybrid, which until now carried a tax burden of €7,600, will be reassessed at just €2,000 — a reduction of nearly 74 percent.

Inflation «feeds» public coffers - Greece’s VAT revenues climb to 11% of GDP, compared with 7.5% in the EU

Inflation has quietly swelled public revenues, particularly through indirect taxation such as value-added tax.

Greece to Digitize Tax Authority Archives by Mid-2026

The digital overhaul is set to reshape the way Greece’s tax administration functions.

Tax Windfall from Soaring Prices Leaves Greek Households Struggling

Τhe surge in revenues has little to do with a more dynamic economy and everything to do with inflationary pressure, which has inflated tax intake through higher prices.

Greece Eyes €2 Billion Tax Relief, But Will It Reach the Most Vulnerable?

As the Greek government prepares to unveil a sweeping tax relief package at the Thessaloniki International Fair, a crucial debate is emerging: will these measures genuinely narrow the country's persistent income gap—or end up reinforcing it? With inequality indicators stubbornly stagnant, the focus on middle-income earners is raising both hopes and concerns.

24 Hours Left: Greece’s Tax Filing Period Nears Its End

Greece approaches the final 24 hours before the July 15 deadline for 2025 income tax filings, amid calls from accountants for a short extension due to technical issues, while the Ministry of Finance stands firm on enforcing the submission cutoff.

Tax Filing Progress in Greece Reaches 86% with Calls for Minor Extension

Of those already processed, nearly 34% have resulted in tax bills, amounting to a total of €3.71 billion in assessed taxes - an average of €1,902 per taxpayer.

Why Public Shaming of Major Tax Debtors Fails to Spur Debt Repayment

Greece’s tax authority is preparing to name and shame individuals and companies owing over €150,000 in unpaid taxes, in a renewed push to pressure high-value defaulters into compliance. But despite the public exposure tactic, data shows the strategy has done little to recover the billions owed to the state.

Investors Back Metlen’s London IPO Plan, Reassured by Greek Tax Loyalty

On Thursday, the stock’s ex-dividend date, Metlen’s share price defied expectations by closing higher, signaling market confidence.

Greece to Offer Tax Fine Discounts Starting October - Here's Who Benefits

This allows them to disclose undeclared income or assets without entering into a formal dispute process.

Three in Four Greek Businesses Owe Tax in Latest Filings

In Greece, nearly three out of four corporate tax returns filed so far this year have resulted in businesses owing money to the state—underscoring longstanding issues within the country’s corporate tax base.

Greece faces rising tax arrears, collections lag behind

Since the beginning of the year, taxpayers in Greece have accumulated an additional €3.19 billion in unpaid taxes.

Greece’s 2025 Tax Season Reveals Heavy Burden on Businesses

According to the data, 74.55% of submitted corporate tax returns are debt-generating, bringing in €577.19 million in revenue for the Greek state so far.

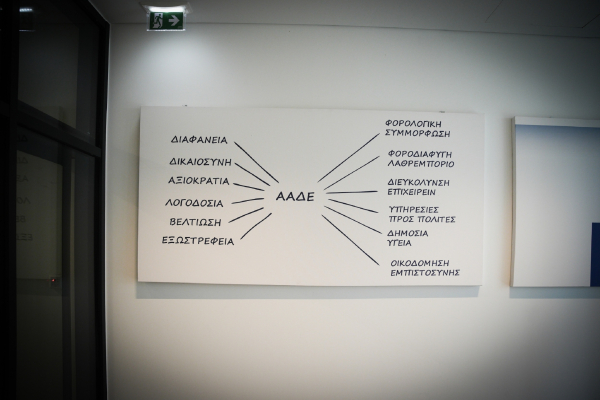

Greece’s Tax Authority Sets Ambitious 2025 Goals with Focus on Revenue Collection and Digital Oversight

Greece’s Independent Authority for Public Revenue (AADE) has rolled out an ambitious 2025 plan focused on ramping up tax collections, accelerating refunds, and expanding audits—with digital enforcement and international cooperation at the core of a sweeping effort to modernize the country’s tax administration.

Greece Mobilizes Tax Inspectors for Summer Season in Tourist Hotspots

As Greece prepares for another busy summer, its Independent Authority for Public Revenue (AADE) has announced a nationwide mobilization of tax inspectors to bolster compliance in key tourist regions.

OECD Flags Greece’s High Tax Pressure on Workers

What is particularly striking in the Greek case is that this increasing burden hasn’t come from a deliberate hike in tax rates or social contributions.

Greece grants major tax relief to freight forwarders with retroactive VAT exemption

The newly tabled amendment grants a retroactive value-added tax (VAT) exemption covering a full decade for auxiliary services provided by licensed freight forwarders in Greece to airline companies.