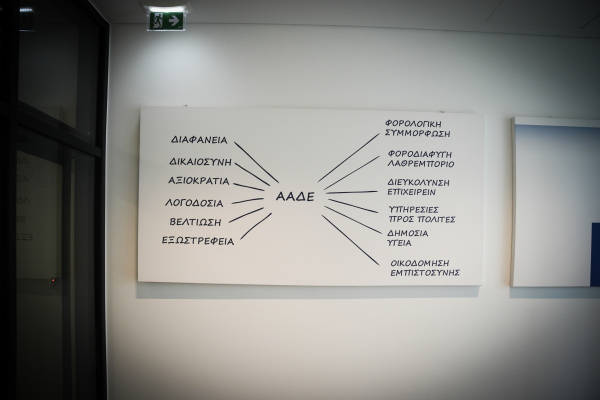

The move is intended to address the uncertainty that often accompanies investment planning and complex business transactions, with the aim of making Greece a more stable and attractive destination for economic activity.

Advance tax rulings are a well-established feature of tax systems in several European Union member states, including Belgium, Germany and the Netherlands. In those countries, they provide taxpayers with an official and typically binding interpretation of how tax law will be applied to specific future transactions, reducing ambiguity and limiting the scope for later disputes with tax authorities.

The rulings are issued at the request of the taxpayer and can cover a wide range of matters, from the taxation of intra-group transactions to the application of tax incentives or special regimes. They are not limited to large multinational groups, but are also used by small and medium-sized enterprises and, in some cases, individuals. Their main value lies in offering advance clarity on tax treatment, allowing taxpayers to proceed with business decisions knowing in advance how they will be taxed.

The International Monetary Fund has examined advance tax ruling regimes extensively and considers them a hallmark of mature and well-functioning tax systems. According to the Fund, such rulings allow taxpayers to understand in advance how tax legislation will be applied in concrete cases, reducing the likelihood of future conflicts with tax administrations and contributing to higher levels of voluntary tax compliance.

However, the IMF has also cautioned that these regimes carry inherent risks if they are not properly designed. When advance rulings remain confidential and are not subject to any form of publication, concerns can arise over transparency, potential losses of tax revenue, or even the granting of unlawful state aid. To mitigate these risks, the Fund recommends a clear and robust legal framework, the centralisation of the ruling process within a specialised unit of the tax administration, and the publication of rulings in anonymised form. This, it argues, helps ensure equal access to information and reduces the risk of preferential treatment.

A key issue is the binding nature of advance tax rulings. Best practice suggests that such rulings should bind the tax authority, while leaving the taxpayer free to decide whether to rely on them. When their conditions are met, they should protect taxpayers from additional assessments, penalties and surcharges. At the same time, international experience underlines the need for careful calibration of their scope and the administrative resources required, particularly in countries where tax administrations face capacity constraints.

Finally, advance tax rulings can have cross-border implications, as they may affect the tax bases of other jurisdictions. This makes cooperation and information exchange essential, particularly within frameworks developed by the European Union and the OECD, where transparency and coordination are increasingly seen as critical to safeguarding fair and effective international taxation.