A growing divide has emerged within Greek industry over the best way to address persistently high energy costs, highlighting broader tensions across Europe about how to support energy-intensive sectors during the green transition. On one side is the Association of Industrial Energy Consumers (EVIKEN), which has openly broken ranks with the country’s main business lobby, the Hellenic Federation of Enterprises (SEV), by calling for the immediate use of a newly approved European support framework and effectively dismissing the option of adopting the so-called “Italian model” for energy cost relief.

EVIKEN’s intervention comes at a sensitive moment, as the Greek government is preparing to announce measures that Prime Minister Kyriakos Mitsotakis had foreshadowed four months ago in an address to SEV’s general assembly. The debate is therefore unfolding not only within industry, but also against the backdrop of imminent policy decisions.

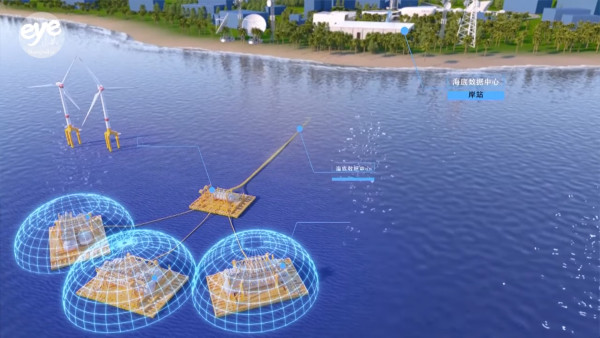

At the center of the discussion is the Clean Industrial Deal State Aid Framework (CISAF), approved by the European Commission on 25 June 2025. CISAF is a targeted state aid regime designed to support European industry as it adapts to climate neutrality. It allows member states to grant aid for investments in net-zero technologies, to introduce temporary measures to ease industrial energy costs, and to support competitiveness while reducing the risk of carbon leakage. The framework complements the EU’s Net-Zero Industry Act, which aims for at least 40% of the Union’s clean technology needs to be met by European production by 2030.

EVIKEN, which represents around 30 medium- and high-voltage industrial consumers in Greece, argues that CISAF offers a legally robust and immediately deployable solution, in contrast to the Italian model, which has not received formal approval from the European Commission. According to the association, CISAF could operate alongside the existing CO₂ cost compensation mechanism, providing a Brussels-endorsed support scheme at a time when Greek manufacturers are facing crucial investment decisions related to decarbonisation. From EVIKEN’s perspective, the discussion around the Italian model has effectively run its course.

The split within Greek industry mirrors a wider European debate. Energy-intensive industries across the EU are intensifying pressure on national governments and EU institutions to take coordinated action to safeguard competitiveness in the face of high electricity prices. In a joint statement by BusinessEurope, which is also backed by SEV, business groups argue for a single European support mechanism based on the Italian model, warning that fragmented electricity markets create uneven competitive conditions between member states.

Criticism of CISAF has also come from prominent industrial voices at the European level. Evangelos Mytilineos, president of European Metals, recently described the framework as “non-functional,” arguing that its conditions significantly limit the scope for meaningful support to heavy industry. He has pointed in particular to provisions encouraging on-site clean energy generation, which he says do not correspond to the operational realities of sectors such as metallurgy.

EVIKEN, however, has welcomed the Greek Ministry of Environment and Energy’s intention to reopen talks with the European Commission on strengthening the CO₂ cost compensation mechanism. At the same time, it has highlighted Greece’s relative disadvantage compared with countries such as Bulgaria and Germany, where industry benefits from guaranteed electricity pricing schemes. The association is urging the government to move quickly to implement an energy cost reduction mechanism under CISAF, arguing that this is essential if Greek energy-intensive industries are to enjoy support comparable to that available elsewhere in the European Union.