Greece’s economic cabinet is weighing a new package of measures that could be announced and partially implemented in 2026, capitalising on additional fiscal space created by the activation of an escape clause for defence spending in 2025. Meanwhile, the bulk of business-focused tax cuts is expected to be unveiled at the 2026 Thessaloniki International Fair—Greece’s main annual policy forum—with implementation slated for 2027.

After the 2025 fair, when tax relief for wage earners and families with children was announced, senior officials at the Ministry of National Economy and Finance had insisted that any further measures would be delayed until 2027 and capped at €1 billion. At the time, cumulative growth in net primary expenditure for the 2024–2026 period had reached nearly 10%, exhausting the limits agreed with the European Commission.

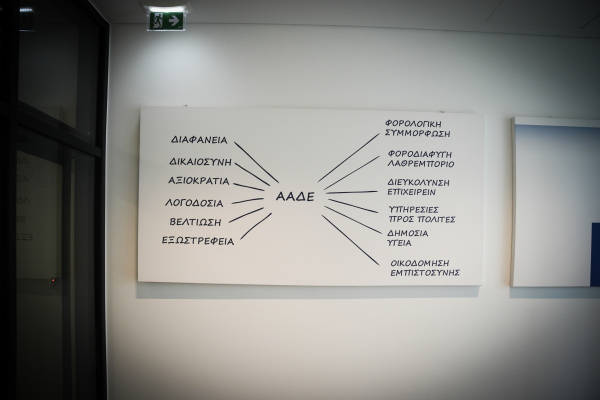

Since then, however, fiscal conditions have improved. Budget execution continues to outperform official targets, largely due to stronger-than-expected revenues from the crackdown on tax evasion. By the end of the year, these revenues were estimated to exceed 2024 levels by around €600 million, a figure that could rise to €800 million once final VAT payments for 2025 are collected. Under EU fiscal rules, such additional revenues effectively reduce expenditure ceilings, creating room for policy initiatives without breaching agreed limits.

Further support comes from the use of the national escape clause for defence spending. According to Greece’s Parliamentary Budget Office, although spending this year is projected to exceed the annual ceiling, cumulative performance over the 2024–2026 period remains compliant. Lower-than-expected spending in 2024 and the accounting treatment of defence outlays leave a negative cumulative balance of roughly 0.3% of GDP—around €750 million—well within permitted thresholds.

By the end of February, the government expects to have a clear picture of revenues, expenditures and total available fiscal space, which is projected to exceed €2 billion. Of this amount, up to €800 million could be used for measures implemented as early as 2026, with additional interventions of up to €1.5 billion earmarked for 2027.

Among the options under discussion are adjustments to pensioner support schemes and long-delayed increases in welfare benefits. On the tax front, the government is considering further reductions for businesses, including the abolition of a long-standing annual levy, cuts to advance tax payments to improve liquidity, and lower social security contributions. Additional relief for rental income and reforms to corporate taxation at group level are also being examined, as Athens seeks to balance fiscal discipline with measures to support growth and employment.