#AADE

Regulators Questioned Over Superficial Audits in Greek Spyware Trial

The wiretapping trial is scheduled to resume on Tuesday with the continuation of Mr Koutsios’s testimony.

Greece Tightens Asset Checks on Tax Authority Staff

Under the new rules, not only AADE employees but also their family members may be examined if their financial information affects the overall picture of an employee’s wealth.

Greece Plans Rewards for Timely Taxpayers as Overdue Debts Surge

Officials are considering a so-called “white Tiresias” system, modeled on the country’s banking credit registry.

Foreign Property Owners in Greece Under Scrutiny for Undeclared Rental Income

The issue primarily concerns citizens from EU and Balkan countries who lease their properties through short-term platforms such as Airbnb or through long-term rental agreements without declaring the income to Greece’s Independent Authority for Public Revenue (AADE).

Greece Plans Wave of Property Auctions as Tax Debt Collection Intensifies

At the top of the auction list is a major property in Nea Ionia, Attica, situated at the junction of 1 Kymis and Byzantium Streets.

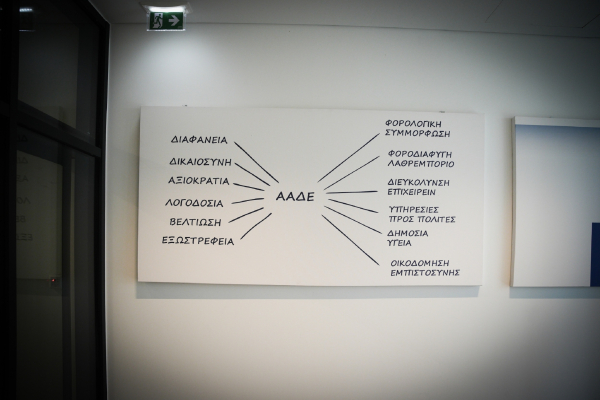

Reorganization at Greece’s Tax Authority Highlights Strategic Focus on Auditing and Compliance

The Independent Authority for Public Revenue (AADE), Greece’s tax administration body, has announced a sweeping reorganization of its internal structure and staffing framework, establishing a total of 15,502 permanent positions.

Greece Bets on AI and Automation in Landmark Tax Administration Reform

Tax returns will be pre-filled automatically with existing data, while taxpayers will receive personalized reminders and guidance.

Greece to Digitize Tax Authority Archives by Mid-2026

The digital overhaul is set to reshape the way Greece’s tax administration functions.

Greece Streamlines Vehicle Import Procedures for Dealers and Private Buyers

Under the new rules, published in the Government Gazette, the system becomes stricter but also more straightforward.

Greek Tax Authority Introduces Rapid-Response Mechanism for Tax Evasion Reports

The reform concerns intelligence reports that often stem from tips or whistleblower complaints and may reveal instances of tax evasion or customs violations.

Greek Customs Uncover Smuggling Haul: Cash, Counterfeits, and... Baklava

One of the more striking discoveries involved attempts to smuggle baklava and precious goods into the country.

Greece Clarifies Debt Relief Rules for Over-Indebted Citizens

Greece’s tax authority has clarified the long-standing process for forgiving debts owed by over-indebted individuals, making clear that debt cancellation is not automatic—even after a court ruling.

Tax Filing Progress in Greece Reaches 86% with Calls for Minor Extension

Of those already processed, nearly 34% have resulted in tax bills, amounting to a total of €3.71 billion in assessed taxes - an average of €1,902 per taxpayer.

Why Public Shaming of Major Tax Debtors Fails to Spur Debt Repayment

Greece’s tax authority is preparing to name and shame individuals and companies owing over €150,000 in unpaid taxes, in a renewed push to pressure high-value defaulters into compliance. But despite the public exposure tactic, data shows the strategy has done little to recover the billions owed to the state.

Greece’s Top Court: Fake Invoice Penalties Don’t Require Full Compliance for Reduction

The case involved a company from Volos that was fined for accepting fake invoices from a related company in Bulgaria.

One in Five Greeks Fails to Pay Taxes on Time, Despite Overall Compliance Holding Steady

Between January and April 2025, timely tax payments in Greece reached €10.99 billion.

Greece faces rising tax arrears, collections lag behind

Since the beginning of the year, taxpayers in Greece have accumulated an additional €3.19 billion in unpaid taxes.

Greece’s 2025 Tax Season Reveals Heavy Burden on Businesses

According to the data, 74.55% of submitted corporate tax returns are debt-generating, bringing in €577.19 million in revenue for the Greek state so far.

Greece’s Tax Authority Sets Ambitious 2025 Goals with Focus on Revenue Collection and Digital Oversight

Greece’s Independent Authority for Public Revenue (AADE) has rolled out an ambitious 2025 plan focused on ramping up tax collections, accelerating refunds, and expanding audits—with digital enforcement and international cooperation at the core of a sweeping effort to modernize the country’s tax administration.

Greece Fast-Tracks Tax Residency as Global Investors and Expats Flock In

Beginning in June, registering as a tax resident and obtaining a Greek tax identification number (AFM) will take just a few days, replacing a process that currently drags on for months.

Greece Steps Up Tax Enforcement, Eyes Major Revenue Boost by 2026

Greece is stepping up its campaign against tax evasion, with authorities preparing to roll out a new set of measures that could bring an additional €1 billion into state coffers this year.

Greece to Revamp Tax Administration in 2025 with Major Digital Reforms

A central focus of the reforms is the expansion of digital tax services.

Greece’s Tax System Set for Digital Overhaul with EU-Backed Investment

Greece’s Independent Authority for Public Revenue (AADE) has announced an ambitious five-year modernization plan, backed by over €270 million from the European Union’s Recovery and Resilience Facility.

Greece’s Tax Authority Strengthens Audit Program for 2025

Special attention will be given to cases involving prosecutorial orders, high-risk taxpayers, and compliance checks on capital transfer tax declarations.

Greece's Tax Authority Takes on Corruption: Key Strategy Under Review in 2025

Greece's Independent Authority for Public Revenue (AADE) is entering a critical phase in its fight against corruption within the tax administration.

New Customs Reforms in Greece Aim to Streamline Trade and Improve Oversight

Greece is overhauling its customs procedures with new Customs Audit Centers (TEK) and updated regulations.