An investigation by Dnews.gr reveals that Greek arms dealer Stavros Komnopoulos spent the past decade cultivating ties with both key figures in the Iranian regime and major Israeli defense players.

Komnopoulos, a familiar name in Greece due to past legal entanglements over arms procurement deals involving Super Puma helicopters and Exocet missiles, appears to have pursued an expansive and contradictory network of alliances. During Greece’s financial crisis and the austerity period that followed, Komnopoulos developed a business relationship with Ali Naghi Khamoushi, one of Iran’s most powerful businessmen and a close associate of the country’s Supreme Leader, Ayatollah Ali Khamenei.

A decade after these dealings with Tehran began, Komnopoulos’ companies reportedly facilitated the entry of Israeli cyber-intelligence figures Tal Dilian and Rotem Farkash into the Greek market. Dilian, a former senior officer in Israel’s intelligence services, and Farkash, formerly with the Israeli Defense Forces, are the founders of Intellexa and Cytrox respectively — the two companies behind the controversial Predator spyware.

This web of connections — spanning sworn regional enemies — is as unexpected as it is geopolitically explosive. Komnopoulos had, in recent years, earned the reputation among arms trade circles as “Israel’s man in Athens,” thanks to his representation of major Israeli defense firms such as Rafael Advanced Defense Systems and Aeronautics Defense Systems through his company Kestrel. Notably, Kestrel played a role in supplying SPIKE NLOS missile systems to the Hellenic Army.

The Komnopoulos Companies' Involvement in the Predator Spyware Scandal

Over the past five years, Predator spyware has been deployed by governments around the world to surveil journalists, politicians, and members of civil society. Produced by the Intellexa consortium, the notorious spyware found a gateway through Greece—facilitated by the Greek Ministry of Foreign Affairs—into the hands of authoritarian regimes such as Sudan’s military junta, a key player in the country’s ongoing civil war, as well as the governments of Vietnam and Madagascar. The global scale of the surveillance scandal was underscored by reports documenting that Vietnam allegedly used Predator to target members of the U.S. Congress.

At the center of this export operation was the Greek company Intellexa S.A., which, as revealed by investigative journalists such as Thanasis Koukakis, served as a hub for Predator’s international distribution. According to multiple reports, the Greek government expedited work permits for Intellexa’s Israeli staff and approved software exports to third countries via the Ministry of Foreign Affairs, bypassing European regulatory frameworks.

The operations of Intellexa triggered international outrage, ultimately prompting the U.S. Department of the Treasury (OFAC) to impose sweeping sanctions on Intellexa founder Tal Dilian, his partner Sara Hamou, and several associates. These sanctions targeted a network of affiliated firms, including Greece-based Intellexa S.A., Intellexa Limited and Thalestris Limited in Ireland, Cytrox AD in North Macedonia, and Cytrox Holdings ZRT in Hungary.

Among the individuals identified by U.S. authorities as key players behind Predator were Felix Bitzios, shareholder and deputy CEO of Intellexa S.A.; Andrea Nicola Constantino Hermes Gambazzi, Dilian’s legal counsel and representative of Thalestris Limited and Intellexa Limited; and Israeli national Merom Harpaz, a senior executive and the consortium’s lead technical officer.

In Greece, Dilian, Hamou, and Rotem Farkash collaborated with four local businessmen to run Intellexa: Felix Bitzios, Giannis Lavranos, Stavros Komnopoulos, and Panagiotis Tamνakidis—Komnopoulos’ nephew.

Rafnar, Tamνakidis’ company, acted as a guarantor for Intellexa to lease its headquarters in the southern suburbs of Athens. Meanwhile, Kestrel, owned by Komnopoulos, rented the upscale residences used by Intellexa’s Israeli technical team, including Farkash and Harpaz.

According to investigative outlet Inside Story, Cyprus-based Feroveno Limited, controlled by Dilian and Hamou, conducted transactions throughout 2022 with European Investment Holdings Services and Trading Co S.A., a company linked to Kestrel. Notably, both Stavros Komnopoulos and Panagiotis Tamνakidis have served on the company’s board.

It is important to note that, as of the time of this writing, neither Komnopoulos nor Tamνakidis has been formally charged in connection with the spyware scandal. However, the findings were reviewed by Supreme Court Deputy Prosecutor Achilleas Zisis, who referred other individuals involved for prosecution on misdemeanor-level offenses.

Multifaceted Cooperation with Iran

Dnews.gr has uncovered compelling evidence pointing to a long, multifaceted collaboration between Stavros Komnopoulos and the Iranian regime. Central to this relationship was Ali Naghi Khamoushi, a powerful economic and political figure closely aligned with Supreme Leader Ayatollah Khamenei. Khamoushi is widely regarded as the godfather of Iran’s petrochemical industry. The revelation is striking, especially considering Komnopoulos’ apparent ties to Israel’s defense industry—an avowed adversary of Iran.

The cooperation between Komnopoulos and Iran appears to have spanned several fronts. It included the creation of a clandestine tanker fleet to export Iranian oil in defiance of international sanctions, the supply of aircraft, the trade of food commodities, and even the facilitation of Greek visas for individuals connected to the Iranian regime.

Part of the correspondence obtained by Dnews.gr in the course of its investigative reporting includes communications between Komnopoulos, his associates, and Iranian counterparts. Some of this correspondence was also included Felix Bitzios—one of the central figures in Greece’s wiretapping scandal—who at the time was working with Kestrel. Also included was Greek shipowner Dimitris Cambis, who in 2013 was listed under U.S. sanctions (OFAC) for his dealings with Iran. Cambis had admitted to entering into an agreement with the National Iranian Tanker Company.

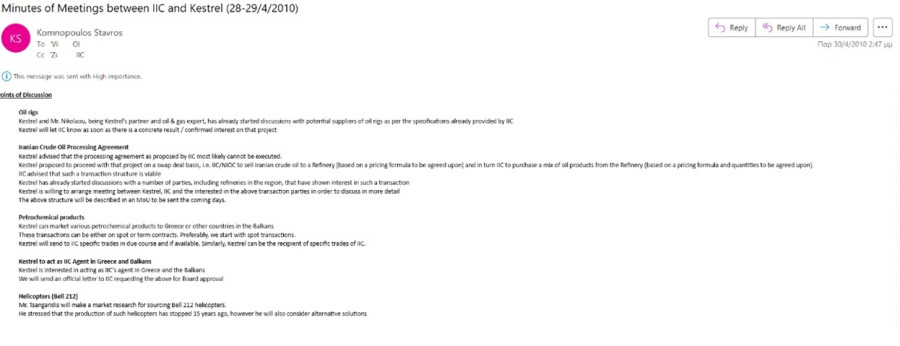

Emails show that negotiations between Komnopoulos and Ali Naghi Khamoushi's team took place in Zurich, Athens, and London. One particularly revealing email dated April 30, 2010, and signed by Komnopoulos himself, outlines meetings held on April 28 and 29 between Kestrel and the Iran Investment Company (IIC), attended by senior executives and advisors from both sides, as well as representatives from the Fama Group.

The summary email reveals that discussions covered a broad spectrum of issues, with a strong focus on energy, transport, and commodities. Special emphasis was placed on oil-related activities. Kestrel, through a specialized associate identified as Mr. K.N., had already initiated contact with potential suppliers of oil drilling platforms, according to Iranian technical requirements. The company committed to updating the IIC once tangible progress was made. Regarding a proposal by the IIC for the processing of Iranian crude oil, Kestrel expressed reservations about the feasibility of the plan as originally presented. Instead, it proposed a swap deal: Iranian oil would be supplied to a refinery, which in return would deliver refined petroleum products in agreed quantities and prices. The Iranian side tentatively accepted the proposal, and talks with potential partners had begun.

In the petrochemical sector, Kestrel signaled its readiness to supply products to Greece and the Balkans through spot transactions and proposed acting as IIC’s regional representative. On the aviation front, an associate identified as Mr. A.T. from Galain Aviation had taken on the task of investigating the availability of Bell 212 helicopters, despite their production having ceased 15 years prior, and was also exploring alternatives. Additionally, the possibility of leasing or purchasing aircraft was on the table, with A.T. promising to present a detailed proposal including transaction structure and payment schedule by May 5.

In terms of commodity trade, Kestrel undertook to evaluate IIC’s requests for food products and deliver a preliminary assessment by May 7. It also committed to providing details on the importation of telegraph poles. Finally, the company pledged to inform the Iranian side about the process for securing multiple-entry visas and residence permits in Greece—part of the broader framework of their collaboration.

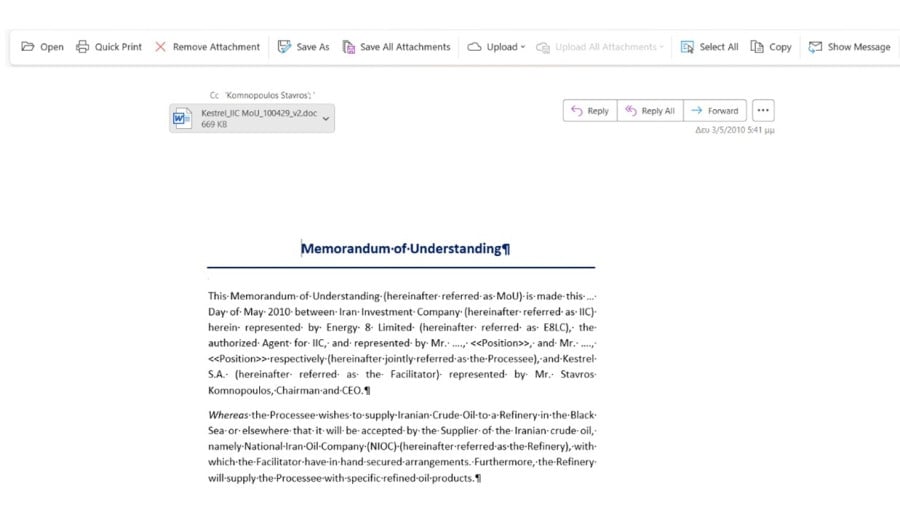

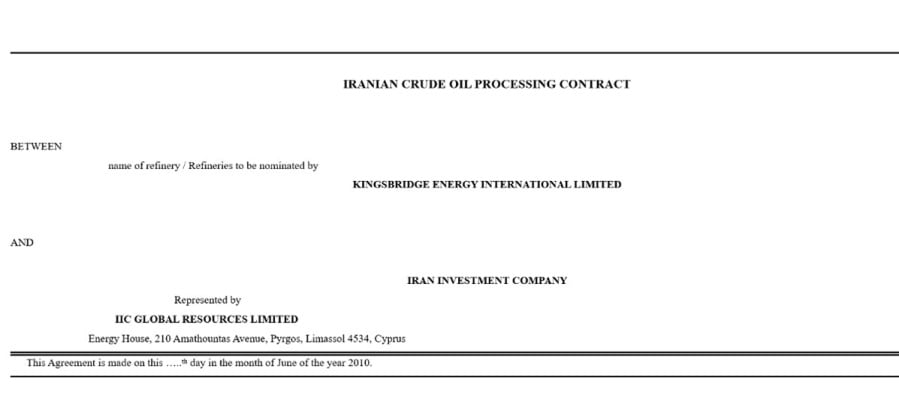

A second email dated May 3, 2010, sheds light on a Memorandum of Understanding (MoU) signed between Iran Investment Company—represented through Energy 8 Limited—and Kestrel, whose President and CEO, Stavros Komnopoulos, signed on its behalf. According to the email, both parties agreed to collaborate on supplying Iranian crude oil to a refinery located either in the Black Sea region or another location approved by the National Iranian Oil Company (NIOC). The interested buyer, referred to as the “Processee,” expressed a commitment to sign a contract for the purchase of up to 300,000 metric tons of Iranian crude per month over a three-year period.

The pricing of the crude was to be negotiated between the buyer and the refinery, with Kestrel acting in an advisory capacity. The agreement also included provisions for the buyer to purchase refined petroleum products from the same refinery. Details such as product quantities, types, and prices would be finalized at a later stage, again with Kestrel’s involvement.

Regarding payments, the refinery was to issue a revolving letter of credit to the buyer equal to the value of the delivered crude, while the buyer would, in turn, issue a letter of credit for the refined products. Additionally, the buyer agreed to provide a bank guarantee in favor of Kestrel to cover its monthly fees.The email also noted that delivery logistics, along with quality and quantity inspections, would be jointly agreed upon, with inspections carried out by an independent third party approved by both buyer and refinery. Inspection costs were to be split: the seller covering those at the loading port and the buyer at the destination port.

Finally, Kestrel’s compensation was to be calculated in cents per barrel of crude received by the refinery and would remain in effect throughout the duration of the agreement, including any possible extensions. This fee would be paid from the proceeds of the refined product sales. The MoU was to be governed by Greek law, with representatives from all involved parties signing off on the agreed terms.

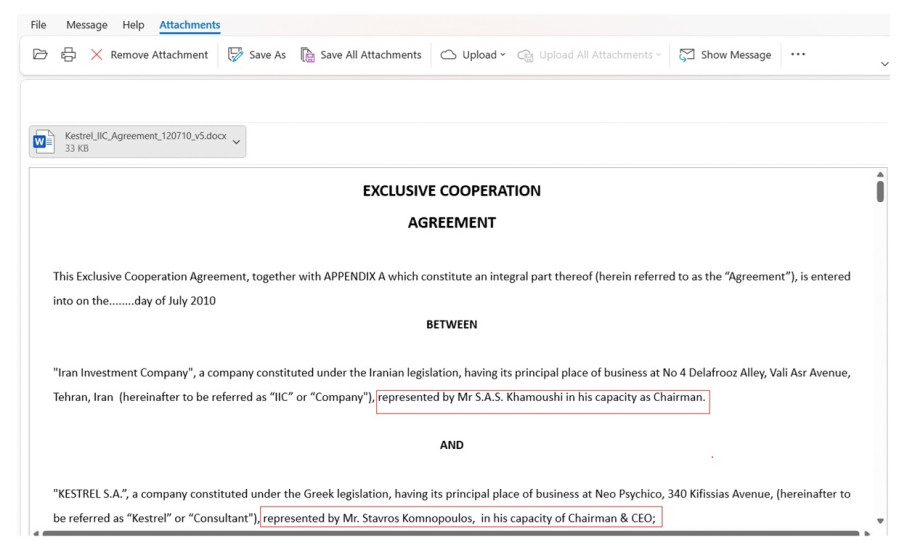

A revealing third email, sent in July 2010, sheds light on a high-level agreement involving the Iran Investment Company (IIC) and the Greek firm Kestrel. The email included an Exclusive Cooperation Agreement aimed at facilitating a major commercial deal for the supply of Airbus A321-200 aircraft.

Represented by its president, Ali Naghi Hamoushi, the IIC expressed its intention to initially acquire 10 aircraft through a 15-year leasing arrangement, with plans to later expand the agreement to cover a total of 60 aircraft. Kestrel, through Stavros Komnopoulos, committed to providing advisory services concerning the structure of the transaction, securing financing, and identifying appropriate entities for the procurement and leasing of the planes.

Under the terms of the agreement, Kestrel was to receive a success fee amounting to 3% of the financing secured, as well as a 10% stake in the share capital of a special-purpose vehicle (NewCo) to be established for managing the aircraft. The deal also included an exclusivity clause, a confidentiality clause valid for two years beyond the agreement’s termination, and stipulated that any legal disputes would fall under the jurisdiction of the courts of Athens.

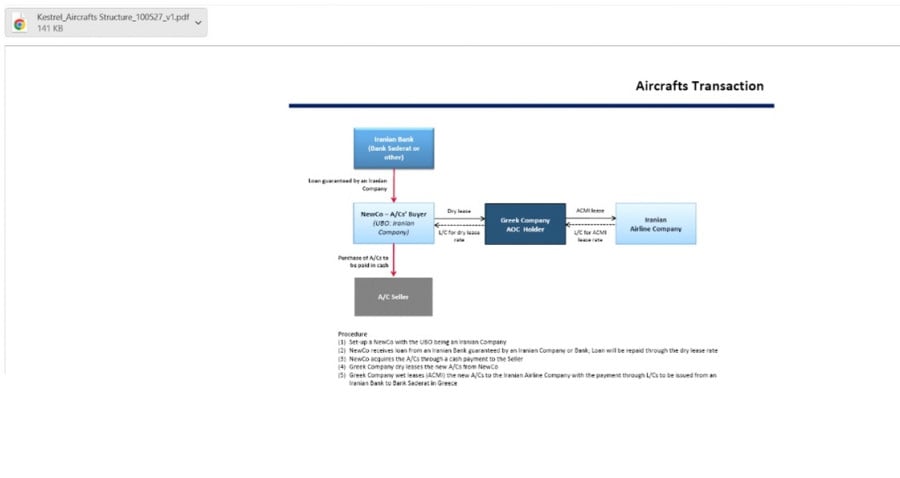

Annex A of the agreement outlined the key terms of the proposed transaction structure. It detailed the formation of NewCo, the roles of all involved parties—including the company, a financial institution, and an ACMI (Aircraft, Crew, Maintenance, and Insurance) operator—and the mechanisms by which ownership of the aircraft would be transferred at the end of the 15-year lease period.

Following this email, an exchange of electronic correspondence took place between executives of Kestrel and IIC Global. The initial communication came from Victor Olsen of IIC, who addressed a message titled "STRICTLY PRIVATE" to G.P. of Kestrel. In this message, the official position of IIC regarding the agreement for the acquisition of ten AIRBUS A321-200 aircraft is clearly outlined. Olsen informs that the company’s president, Ali Naghi Hamousi, will attend the meeting scheduled for July 19 in Zurich, a decision made following intervention by the Iranian ministry, due to the project's strategic significance.

Following the initial letter, G.P. responds on behalf of Kestrel, expressing the company’s honor at the involvement of Ali Naghi Khamoushi and confirming the possibility of a meeting in Athens on July 18, during which both parties would travel together to Zurich. He notes that the proposed financial and equity structure is broadly in line with previous discussions, though specific aspects will be subject to negotiation during the meeting.

The email exchange reveals intense activity and careful preparation ahead of the critical meeting in Zurich, underlining the importance of the pending agreement for both the parties involved and the Iranian government authorities.

Among the emails obtained by Dnews.gr is also a draft financing plan for the transaction concerning the Airbus A321-200 aircraft.

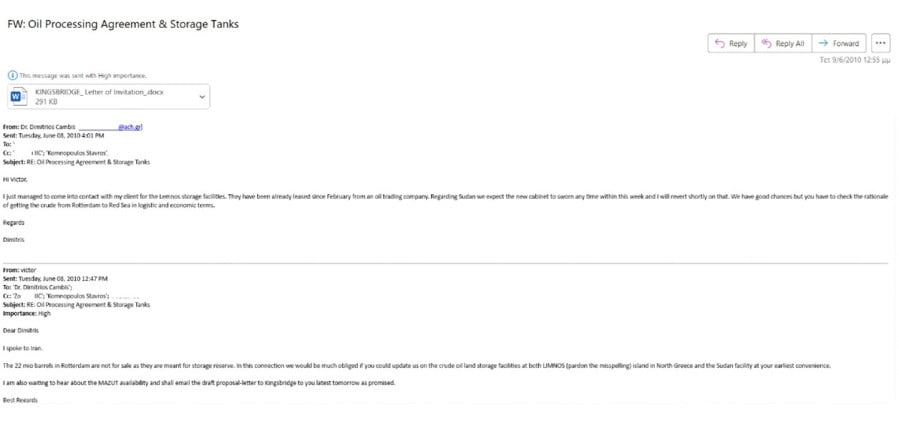

Even more revealing is a fourth email, which was carbon copied to Stavros Komnoupoulos. The message, dated June 8, 2010, was sent by shipowner Dimitrios Cambis to Victor Olsen, the associate of Ali Nagy Hamousi. In it, Cambis informed Olsen that he had contacted his client regarding the storage facilities in Lemnos, which had already been leased since February to a commercial oil company. He also commented on the situation in Sudan, noting that a new cabinet was expected to be formed within the week. Furthermore, he suggested assessing the rationale and economic feasibility of transporting crude oil from Rotterdam to the Red Sea.

Victor Olsen, for his part, stated that he had contacted Iran and was informed that the 22 million barrels in Rotterdam were intended for strategic storage and were not available for sale. Olsen sent a draft agreement, requesting Cambis’s assistance in calculating the costs of the refined products, as well as processing, transportation, and storage expenses. He emphasized that this data was essential for estimating revenues and expenditures, and for negotiating the profit-sharing model between Kingsbridge, IIC, and the intermediaries involved.

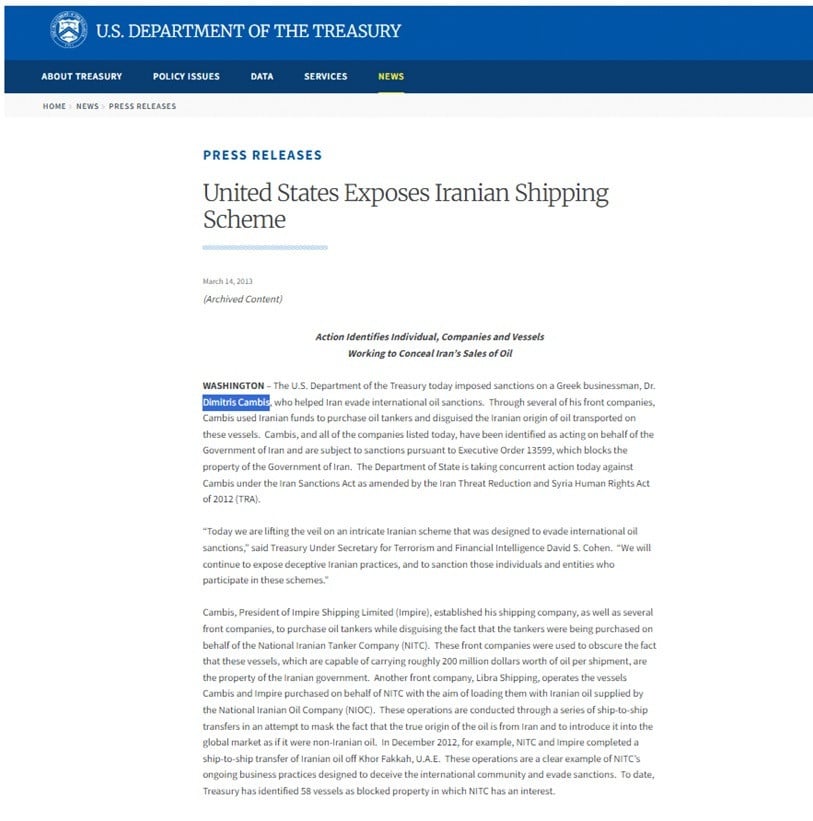

The emails revealed today by Dnews.gr, exposing the collaboration between Komnopoulos and Cambis with the Iranian regime as early as 2010, have been confirmed—at least in the case of Mr. Cambis—by U.S. authorities.

On March 14, 2013, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced that the United States had uncovered a sophisticated network used by Iran to circumvent international oil sanctions. As a result of this discovery, OFAC imposed sanctions on Greek shipowner Dimitris Cambis, along with a number of companies and oil tankers linked to him.

According to the Treasury Department, "through several of his front companies, Cambis used Iranian funds to purchase oil tankers and disguised the Iranian origin of oil transported on these vessels. Cambis, and all of the companies listed today, have been identified as acting on behalf of the Government of Iran and are subject to sanctions pursuant to Executive Order 13599, which blocks the property of the Government of Iran".

The U.S. Office of Foreign Assets Control announced that Cambis, the president of Impire Shipping Limited, established his company and several front companies in order to acquire oil tankers on behalf of the National Iranian Tanker Company (NITC). These tankers, capable of transporting cargoes worth approximately $200 million, were used to ship oil for the National Iranian Oil Company (NIOC). The true origin of the cargo was concealed through ship-to-ship transfers, as documented in one instance in December 2012 off the coast of Khor Fakkan in the United Arab Emirates.

The U.S. Treasury Department named all eight tankers purchased by Cambis on behalf of NITC, along with the corresponding ownership companies and a network of Iranian front companies that financed the transactions. Among these were Sima General Trading, Polinex General Trading, Asia Energy General Trading, and Synergy General Trading. U.S. authorities revealed that Sima and Asia Energy had transferred more than $100 million to Impire, while Polinex had also contributed funds toward the acquisition of the vessels.

No Response

As part of its investigative reporting Dnews.gr reached out to Stavros Komnopoulos for answers regarding his controversial dealings with the Iranian regime. However, as of the time of publication, there has been no response from him.

What emerges from the investigation is that Komnopoulos’s Israeli partners—whether in the case of Intellexa, or in defense companies such as Rafael Advanced Defense Systems and Aeronautics Defense Systems—failed to conduct the necessary due diligence into the commercial background of their Greek associate. In plain terms, Israeli intelligence missed or overlooked Komnopoulos’s complex and high-profile collaborations with Ali Naghi Hamoushi and the Iranian regime, despite the fact that the United States had already laid the groundwork by sanctioning Komnopoulos’s associate, shipping magnate Dimitris Cambis.

Crucially, leaked emails also show that Felix Bitzios—who owns a 35% stake in Intellexa and was a close associate of Tal Dilian in the Predator spyware venture—was at the time acting as a kind of "accountant" for Kestrel in its deal with the Iranians, overseeing parts of the financial architecture behind the agreement. These revelations point to a long-standing relationship between Bitzios and Komnopoulos, dating back to the early 2000s.

Ultimately, Dnews.gr’s findings place a spotlight on all the Israeli parties involved with Komnopoulos during Intellexa’s establishment in Greece—individuals and companies who appeared unaware that just a few years earlier, their business partner was allegedly facilitating the circumvention of international sanctions by helping Iran acquire aircraft, helicopters, raw materials, travel documents, and, most crucially, access to "open seas" for the export of Iranian oil.