The draft resolutions of CrediaBank’s Board of Directors, released on Thursday ahead of an extraordinary general meeting scheduled for 16 March, are marked by particularly cautious and legally robust wording. At the meeting, shareholders will be asked to approve a €300 million share capital increase. A central element of the proposal is the possibility of granting the Board authorisation to restrict or even fully abolish the pre-emption rights of existing shareholders in future capital increases carried out through the issuance of new shares, an issue that has already drawn public attention in recent days.

According to the draft, the Board considers the potential exclusion of pre-emption rights to be justified and in the best interests of the bank under current market conditions. Such flexibility would allow the pricing of new shares to be determined using internationally recognised mechanisms, including book-building, enabling a transparent, fast and competitive process that shortens the time required to complete the capital increase. The document also clarifies that the issue price of new shares may not be set below their nominal value. Beyond procedural efficiency, the Board argues that this approach could help broaden the shareholder base and improve both the free float and the liquidity of the bank’s shares.

The draft resolutions also stress that the removal of pre-emption rights does not automatically exclude existing shareholders from participating in the capital increase. The Board would retain the discretion, though not the obligation, to provide preferential treatment to current shareholders in the allocation of new shares, should they choose to participate.

The stated objective of such an arrangement would be to preserve their ownership percentages, based on a record date to be defined at a later stage. This mechanism would effectively replace the traditional, automatically exercisable pre-emption right with a form of special allocation designed to limit or prevent dilution. However, the draft makes clear that this option would be assessed by the Board at the time, meaning that participation by existing shareholders would depend on market conditions, the structure of the transaction and the strategic priorities of management. In this sense, the provision is presented as a safeguard rather than a firm commitment, allowing the bank to retain flexibility in attracting new investors and executing the capital increase swiftly.

Of particular note is the explicit reference to the potential participation of the Hellenic Corporation of Assets and Participations (HCAP), the Greek state holding company and successor to the Hellenic Financial Stability Fund. The draft clarifies that in the event of HCAP’s involvement, the relevant provisions of Law 3864/2010 would apply. Following amendments introduced in 2021, the law allows HCAP, in connection with approved capital increases, to exercise some or all of its pre-emption rights, to subscribe up to its existing ownership percentage regardless of the structure of the capital increase, including cases where pre-emption rights are restricted or excluded, or to participate in the allocation of any unsubscribed shares, provided such an allocation is предусмотрed.

In parallel, HCAP retains special veto rights, exercisable by decision of its General Council, allowing it to block the issuance of shares or other ownership instruments by credit institutions in which it holds a stake. Any decision by HCAP to participate in a capital increase must be preceded by a resolution of its General Council, based on reports from two independent financial advisers. These advisers are required to confirm that participation would help maintain, protect or enhance the value of HCAP’s existing stake or improve its prospects for eventual divestment, taking into account prevailing market conditions and the bank’s business plan at the time the decision is taken.

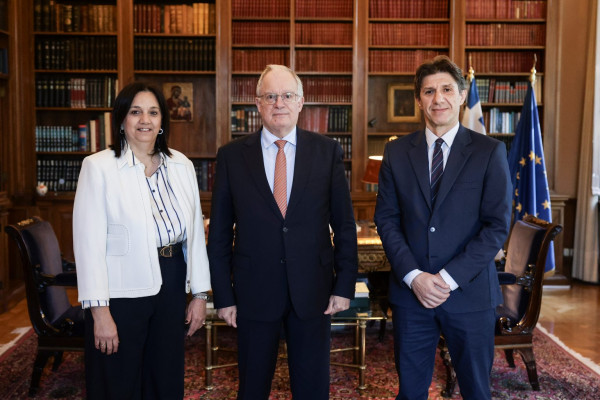

Against this backdrop, HCAP’s chief executive, Giannis Papachristou, is expected to act swiftly and to carry out the necessary briefings at parliamentary level, particularly if it is concluded that HCAP’s stake in CrediaBank should fall from 36.16% to below the 33% threshold that constitutes a blocking minority under Greek corporate law. For many observers, maintaining a holding of at least 33% is the point at which a special allocation of new shares to existing shareholders effectively shifts from being optional to becoming a practical necessity.