Euronext has taken the first concrete step toward establishing a pan-European Support and Technology Center in Athens, a move that underscores the Greek capital’s emerging role within the Group’s European financial and technology ecosystem.

The initiative was formalized with the incorporation of a new subsidiary in Greece by the Dutch entity Euronext IP & IT Holding BV, signaling a strategic decision to position Athens as a key technology hub within Euronext’s federated infrastructure.

The newly established company, Euronext Technologies Greece, is headquartered in the Athens Stock Exchange building and was incorporated with share capital of €25,000. Its mandate spans a wide range of information and communication technology services, including the design, development, implementation and maintenance of IT systems and applications, as well as technical support and advisory services related to software, systems and digital infrastructure. The company will also manage and exploit intellectual property assets, such as software, source code, licenses, know-how and databases.

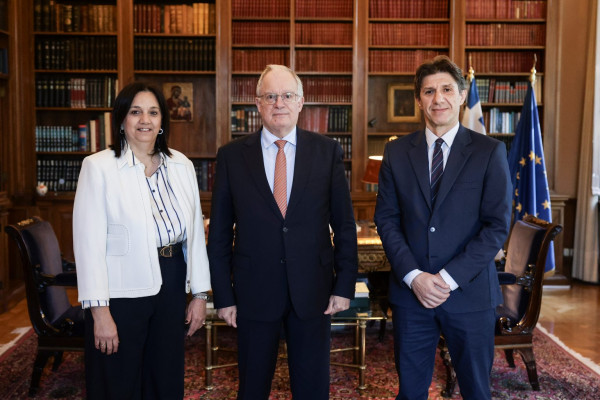

Euronext Technologies Greece will be jointly managed by two senior Euronext executives: Group Finance Director Bernard Holsboer and Group Chief Operating and Information Officer Manuel Bento, highlighting the strategic importance the Group attaches to the initiative.

In responses provided to Dnews,gr, Euronext said Athens was selected following a strategic assessment of its role within the Group’s pan-European operating model. The city is expected to play a critical role in supporting core market systems deployed across multiple jurisdictions. The Support and Technology Center is scheduled to begin operations in 2026 and is designed to complement, rather than replace, the existing activities of the Athens Stock Exchange, reinforcing Euronext’s technology footprint in Greece under its federal model.

Euronext also stressed that the creation of the new subsidiary does not represent a spin-off or a transfer of functions from the Athens Stock Exchange. Instead, it reflects a broader commitment to investing in Greece by leveraging local talent and technological capabilities to meet group-wide operational needs.

While the Group continues to evaluate how best to organize its resources across markets, Euronext made clear that there are no plans to alter the current operating model of the Athens Stock Exchange, which it views as a core pillar of its federated structure.