Despite official narratives about “stabilisation” and a “return to normality,” the underlying reality points to a persistent lag in decision-making. Key government choices are being postponed, while market expectations—particularly those linked to liquefied natural gas (LNG) and Greece’s emerging role as a regional gateway—are built on assumptions that domestic policymakers and companies only partially control.

Much of the low-key but sustained criticism focuses on delays in resolving core regulatory issues. The long-awaited spatial planning framework for renewable energy, the rules governing electricity storage, market flexibility mechanisms, and the broader architecture of the power market are all progressing more slowly than the rapid transformation of the energy mix itself. Investment continues, but often without clear long-term visibility. As a result, the system accumulates expectations first and is then forced to adapt to them retrospectively.

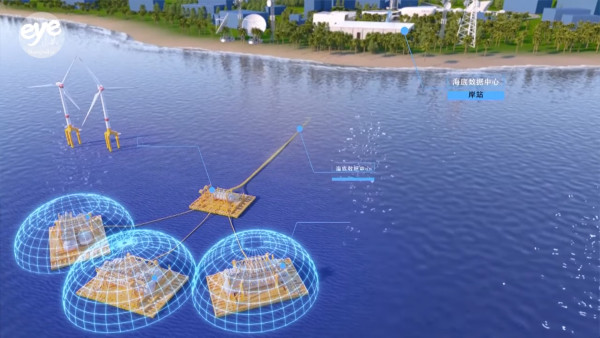

At the same time, political messaging around LNG has fuelled ambitious narratives. Greece is indeed strengthening its position as an entry point for LNG into Southeast Europe, leveraging infrastructure such as the terminal at Alexandroupoli, the existing facilities at Revithoussa, and the so-called Vertical Corridor that channels gas northwards into the Balkans and Central Europe. For international observers, however, it is important to note that many of the decisive variables shaping this strategy lie beyond national control. Weather conditions, the health of European industry, global LNG price cycles, and shifting geopolitical alignments can all rapidly undermine even the most carefully constructed projections.

Looking ahead to 2026, electricity prices may experience a moderate easing compared with the extremes of recent years, but volatility is unlikely to disappear. Gas-fired generation continues to play a critical balancing role during peak hours, keeping power markets exposed to fuel price swings. In the gas sector itself, Europe’s determination to fully sever its dependence on Russian supplies becomes a central pricing factor, with traders increasingly discounting the definitive end of Russian flows and embedding uncertainty into forward contracts.

In the retail electricity market, consolidation is advancing steadily. A small number of large, vertically integrated groups are strengthening their positions, benefiting from scale and portfolio diversification, while consumers gravitate toward fixed-price contracts in search of predictability. Although this shift is rational from a consumer perspective, it also raises concerns about whether effective competition can be sustained without stronger regulatory scrutiny and transparency.

Equally critical is the state of electricity networks. Greece’s transmission system operator, ADMIE, is responsible for delivering one of the most ambitious investment programmes in its history, including major island interconnections and extensive grid reinforcements. Yet as final decisions on funding structures and regulatory arrangements are repeatedly delayed, the risk grows that today’s postponements will translate into higher costs for consumers in the future. For external observers, this tension between strategic ambition and institutional inertia may well define the country’s energy equation in the years leading up to and beyond 2026.