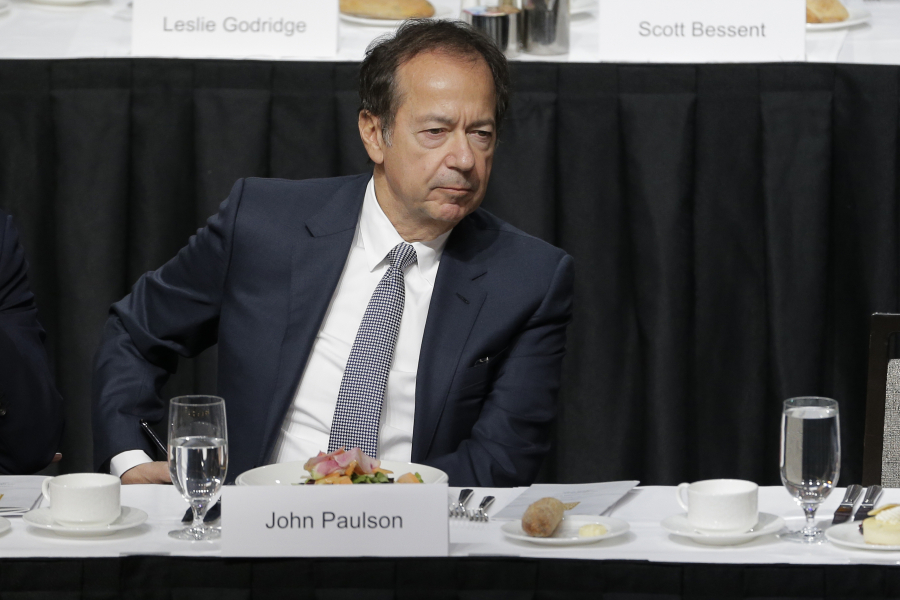

The year 2025 marked an especially active period for Paulson & Co. Inc., yet a closer look at the hedge fund’s transactions reveals a striking divergence between the performance of its U.S. investments and those made in Greece. While positions in American markets broadly confirmed the effectiveness of the strategy pursued by the firm led by John Paulson, its Greek exposure failed to deliver the anticipated results, largely due to unfavorable timing rather than a lack of underlying conviction.

The most illustrative example was the fund’s move involving Piraeus Financial Holdings S.A., one of Greece’s largest banking groups. In February 2025, Paulson & Co. sold 35 million shares via an accelerated bookbuilding transaction. The disposal represented approximately 2.8% of the bank’s share capital and was completed at a price of €4.58 per share, raising around €160 million. At the time, the sale was framed as a portfolio rebalancing exercise, with the fund maintaining its status as the bank’s largest shareholder, holding close to 14%.

Despite retaining a sizeable strategic stake and publicly reiterating its confidence in the bank’s management and long-term prospects, subsequent market developments did not support the decision to scale back exposure. In the months that followed, the share price climbed sharply, reaching a high of €7.654 and currently trading around €7.01—well above the level at which the shares were sold. Based on today’s valuation, the 35 million shares that were divested would now be worth roughly €245 million, compared with the €160 million actually realized at the time of sale. The gap of €2.43 per share translates into a missed potential gain of nearly €85 million, highlighting how the timing of the transaction ultimately worked against the fund.

This episode underscores the broader conclusion that Paulson’s Greek investments in 2025 did not prove successful in hindsight, particularly when measured against the subsequent rally in the local market. The contrast becomes even sharper when set against the overall performance of Paulson & Co.’s U.S. portfolio, as reflected in its SEC Form 13F disclosures.

According to the filing covering the end of September 2025, the reported value of the fund’s equity holdings rose to approximately $2.97 billion, a substantial increase from about $1.65 billion at the end of 2024. This expansion is widely attributed to successful reallocations and strong returns in U.S. markets.

The largest single holding during this period was Perpetua Resources Corp., with around 32.35 million shares valued at more than $654 million, accounting for over 22% of the disclosed portfolio. The second-largest position was Bausch Health Companies Inc., where the fund held 70.76 million shares worth roughly $456 million, representing more than 15% of the portfolio. Significant exposure was also maintained to NovaGold Resources Inc., with a position valued at nearly $240 million, alongside smaller yet meaningful stakes in International Tower Hill Mines Ltd. and Trilogy Metals Inc.

Taken as a whole, 2025 highlights a dual reality for John Paulson. His U.S. investments reinforced his reputation for identifying profitable opportunities, while his Greek positions—most notably the partial exit from Piraeus Bank—stand out as a rare instance where timing, rather than strategy, undermined the outcome.