Greece’s telecommunications landscape is undergoing a major shift, as the rapid expansion of Fiber to the Home (FTTH) technology sparks a new phase of competition among key infrastructure providers. At the heart of this transformation are two dominant players - Public Power Corporation (DEI) and OTE - both vying for long-term leadership in the country’s fixed broadband market.

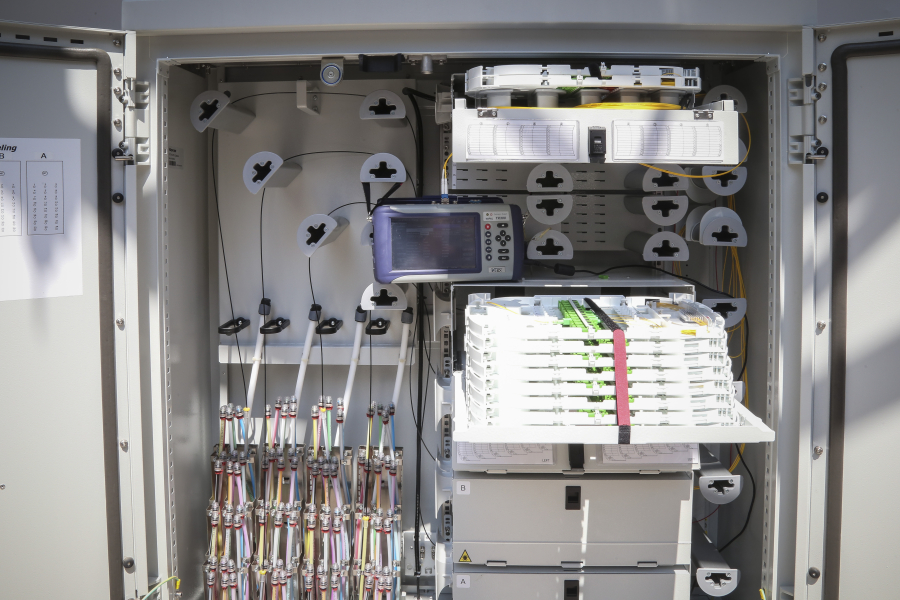

DEI, Greece’s state-controlled power utility, has been accelerating its strategic move into telecommunications under CEO Giorgos Stassis. By the end of June 2025, its FTTH network had reached around 1.3 million households and businesses across the country, marking an impressive 235% increase compared to June 2024, and 94% growth since the end of last year. The company has set its sights on covering 1.5 million premises by the end of 2025.

Adding to its momentum, DEI has launched its own retail internet services through its subsidiary DEI Fibergrid. These offerings are exclusively fiber-based, providing high-speed internet at 500 Mbps, 1 Gbps, and 2.5 Gbps. Already available to 600,000 homes and businesses, the service is steadily expanding into new regions—challenging existing players and boosting consumer choice in a market long dominated by a handful of providers.

In response to DEI’s expanding presence, OTE—Greece’s current market leader—has publicly addressed the changing landscape. OTE President and CEO Kostas Nebis remarked that DEI’s entrance into the market was not unexpected, and that its market share remains below 10%. He also noted that most of DEI’s deployment overlaps with areas where OTE already maintains a strong infrastructure presence, thereby limiting its immediate impact on the company’s dominant position.

Despite the rising competition, OTE continues to strengthen its FTTH rollout. In the first half of 2025 alone, the company added 76,000 net new fiber connections, bringing its total FTTH subscriber base to 470,000. That figure represents 20% of all broadband connections within the OTE Group, underscoring both solid growth and considerable room for expansion.

OTE’s FTTH network now covers nearly 1.9 million premises, with plans to reach 2.1 million by the end of this year and 3 million by 2027. Penetration of its fiber infrastructure has risen to 31%, up from 24% a year earlier, a result that reflects the effectiveness of its long-term strategy and the boost provided by state subsidies aimed at accelerating digital infrastructure.

Interestingly, a substantial portion of the market still relies—directly or indirectly—on OTE’s infrastructure. Around 84% of its own FTTH subscribers are connected via its proprietary network, while 46% of rival providers’ FTTH customers also use OTE’s infrastructure, up from 37% in 2024. This increase is partly due to wholesale agreements between operators that include volume-based discounts.