In a surprise move that reshapes the shareholder structure of Greece’s Alpha Bank, Dutch investment firm Reggeborgh has sold its entire 9.75% stake to three international investment banks. The transaction paves the way for Italy’s UniCredit to increase its holding in the Greek lender to approximately 20%, underscoring a growing strategic partnership and renewed investor confidence in the Greek economy.

UniCredit confirmed on May 28 that it has entered into financial arrangements with the banks to acquire a 9.7% stake in Alpha Bank. The deal was executed at a discount to Alpha’s most recent closing share price and is subject to regulatory approvals. Combined with the 9.6% stake UniCredit already holds, the transaction brings its total interest in Alpha to around 20%.

The Italian banking giant stated that the acquisition aligns with its strategic goals and is expected to generate an additional €180 million in annual net profit. That gain, the bank said, will be returned to shareholders in accordance with its capital return policy. The deal is projected to be finalized by the end of 2025 and will have a moderate impact—approximately 40 basis points—on UniCredit’s CET1 capital ratio. The return on investment is estimated at 16% at the current stage and could reach 19% over time, driven by ongoing synergies from the strategic collaboration.

Andrea Orcel, CEO of UniCredit, said the move reflects growing confidence in Alpha Bank’s leadership and strategy, as well as in Greece’s economic trajectory. “This step further strengthens our successful partnership with Alpha, which has already exceeded expectations,” he said. “Our engagement with the Greek government and leading institutions has been extremely positive and central to the success of this partnership and our new investment.”

The investment is part of a broader strategic alliance between UniCredit and Alpha Bank, which was announced in October 2023. Since then, the two banking groups have collaborated across a range of services, from wealth management to corporate financing and capital markets advisory. Orcel emphasized that the deal is consistent with UniCredit’s strategic roadmap, UniCredit Unlocked, which focuses on achieving sustainable, high-quality growth while delivering value to shareholders.

On the other side of the transaction, Reggeborgh Invest B.V. confirmed it has sold its entire position in Alpha Bank. The Dutch investment firm first entered Alpha’s shareholder base in 2021 through a €0.8 billion capital increase and subsequently raised its stake to 9.75%. The company said the sale, which is expected to be settled by May 30, 2025, reflects its continued confidence in the Greek economy. Reggeborgh CEO Henry Holterman described the transaction as a “positive development” for Alpha Bank and Greece. He expressed appreciation for Alpha Bank’s leadership and the Bank of Greece, while reaffirming Reggeborgh’s intention to continue investing in the country.

In a statement, Alpha Bank said UniCredit’s increased stake reaffirms the strength and potential of their strategic partnership. CEO Vassilios Psaltis welcomed the move, calling it a vote of confidence in the bank and the Greek economy as a whole. He described UniCredit’s new investment as the largest direct capital injection from a leading European bank into Greece’s banking sector in the past two decades. Psaltis highlighted how the partnership has already benefited Alpha’s customers by offering high-value banking and investment products via UniCredit’s pan-European platform.

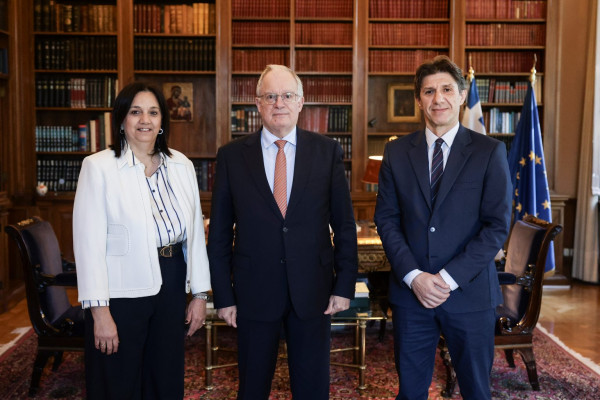

Greece’s Finance Minister, Kyriakos Pierrakakis, has welcomed UniCredit’s decision to increase its stake in Alpha Bank, describing it as a strong vote of confidence in the Greek economy and a positive message to international markets. In a public statement, the minister called the move “a significant development” that highlights the strengthening and resilience of the Greek banking sector.

From the regulatory side, the development was also welcomed by Yiannis Stournaras, Governor of the Bank of Greece, who described it as a “very positive development” for both institutions. He noted that it reflects the significant progress made by Greece’s banking sector and the broader economy, as recognized by repeated credit rating upgrades. Stournaras also used the opportunity to advocate for greater cross-border banking collaboration within the European Union. He argued that such partnerships, alongside the completion of the EU Banking Union and Capital Markets Union, are essential to addressing market fragmentation, improving liquidity, and enhancing economic resilience across Europe.