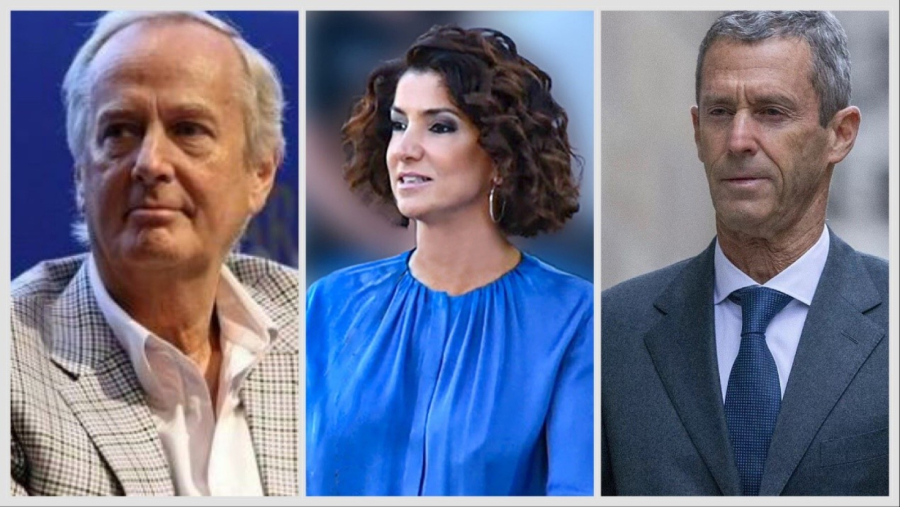

More than a year has passed since the Financial Times first revealed that the ISAB oil refinery in Sicily—formerly owned by the Russian energy giant Lukoil—had been sold to Cyprus-based GOI Energy Ltd, a company with links to Israeli businessman Beny Steinmetz and Alexia Bakoyannis, a Greek businesswoman and niece of the Greek Prime Minister Kyriakos Mitsotakis. The story sparked global attention. ISAB is the third-largest oil refinery in Europe and a critical piece of Italy’s energy infrastructure, responsible for 30% of the country’s diesel consumption and contributing 20% to its overall energy capacity.

However, by the time the Financial Times published its investigation, the ownership structure behind the acquisition had already begun to shift.

Court documents filed at the District Court of Nicosia in a lawsuit by Alexia Bakoyannis’ company, Completicos Holdings, against GOI Energy Ltd and its shareholders and executives, offered a clearer look behind the scenes. According to the filings, it was not Steinmetz but Greek shipping magnate George Economou who had initially financed 90% of the ISAB purchase. Steinmetz had only put up 10%. Although Bakoyannis’ lawsuit was ultimately dismissed by the Cypriot court, it shed light on the actual makeup of the deal and the shareholder dynamics that led to significant internal disputes.

According to the lawsuit, on December 31, 2022, GOI Energy Ltd, together with investment funds, acquired 100% of ISAB through a Share Purchase Agreement (SPA). The transaction involved the purchase of all shares in Litasco—the Lukoil subsidiary that owned the refinery. The deal was financed, in part, by a €115.7 million loan with a one-year term and 8% interest, provided by Argus New Energy Fund AIF V.C.I.C. Limited, a Cyprus-based private equity fund under the control of George Economou’s business network.

This loan included a conversion clause that allowed Argus to convert the debt into shares. If exercised, this option would raise Argus’s equity stake in GOI Energy from 76% to a near-total 99.7%, drastically diluting the ownership of other shareholders. For example, Alexia Bakoyannis’ 2% stake would be reduced to just 0.0175%. This risk was understood from the outset.

In February 2023, GOI Energy Ltd increased its share capital to 1,000,000 shares. Argus held 76%, CEO Michael Bobrov—reportedly holding both Russian and Israeli citizenship—retained 20%, while Bakoyannis’ Completicos Holdings and the Austrian company Sanicula Holdings GMBH (linked to Israeli businessman and former GOI CFO Itzik Gur) each held 2%.

On May 4, 2023, a novation agreement was signed between GOI Energy Ltd, its Italian subsidiary GOI Energy Srl, and Litasco. This transferred all rights and obligations from the original SPA to the Italian entity. Under this agreement, the subsidiary committed to pay an additional €150 million to Litasco, known as the “Completion Shortfall Sum”—the remaining balance of the acquisition price.

By mid-September 2023, the €150 million had not been paid. Litasco responded by threatening legal action over the unpaid balance. At the same time, GOI Energy Ltd was also facing urgent financial obligations to the Italian state, including €50 million for environmental projects tied to the refinery’s operation.

According to the court documents, this financial strain led shareholders and executives—among them Bakoyannis—to seek solutions for raising capital. Bakoyannis offered “to explore funding from Greek banks” and claimed that “one bank had shown interest”, although the bank’s name was not disclosed. However, according to the defendants—whose version was upheld in court—Bakoyannis never formally brought any proposal to the company’s board.

On October 26, 2023, Bakoyannis resigned from GOI Energy’s board. She claimed she had been pressured to leave. The defense presented emails in court in which she cited “other professional obligations requiring her full attention” as the reason for her departure. She also never received an indemnity letter—standard legal protection for outgoing executives—despite requesting one.

GOI Energy Ltd alleged that Bakoyannis had authorized payments without board approval, including deals with companies linked to her and other firms that were allegedly detrimental to GOI. Among these was an €8 million payment to Blue Sky, a company owned by Beny Steinmetz. Bakoyannis denied any misconduct, arguing in court that all payments were either board-approved or contractually justified, including the Blue Sky transfer, which she said was based on a board-approved agreement.

Following her exit, GOI Energy Ltd once again turned to Argus for funding, this time requesting €175 million by November 3, 2023. Argus asked for more information before responding, citing the need to consult its unit holders. Around this time, CEO Michael Bobrov proposed the appointment of five new board members. According to Bakoyannis’ claims, this was done to secure George Economou’s agreement to inject new funds into the company.

On November 6, 2023, after the board restructuring, Argus formally notified its investors that without the requested €175 million, GOI Energy Ltd would incur losses and risk forfeiting control of the ISAB refinery. In her lawsuit, Bakoyannis alleged that this figure was artificially inflated by the new management to justify raising capital and diluting minority shareholders through a new share issuance or convertible debt.

On November 17, 2023, Bakoyannis succeeded in obtaining a temporary injunction to prevent changes in GOI Energy Ltd’s share structure.

However, the District Court of Nicosia later overturned this decision. Presiding Judge Tonia Nicolaou issued a sharply worded ruling, stating that the legal arguments presented by Bakoyannis were “confused” and contradictory. On one hand, she claimed shareholder oppression and sought protection from board decisions. On the other, she challenged the legality of board appointments while rejecting the case as a derivative action. The judge noted that the lack of legal clarity permeated the entire case, leaving the court unable to rule in her favor.

This article was originally published on Dnews.gr on December 19, 2024.